Пособие Л. Д. Червяковой «Язык делового общения» стр. 4-10 Чтение и перевод рекламных текстов

| Вид материала | Конспект |

- Г. В. Психология делового общения. Бороздина Г. В. Психология делового общения : Учебное, 2307.7kb.

- Киянова ольга Николаевна Заведующая кафедрой, 27.74kb.

- Правила делового этикета. Этикет деловых отношений. Этика делового общения 10 Азы делового, 313.16kb.

- История: стр. 27 ответы на вопросы (устно). Английский язык: стр. 14, упражнение, 5.26kb.

- Содержание дисциплины, 34.56kb.

- М. В. Пшеничнов психология делового общения методическое пособие, 277.22kb.

- Легенды и мифы делового общения, 396.06kb.

- Примерный учебно-тематический план Раздел и тема Количество часов всего, 49.42kb.

- Адрес: г. Москва, Ул. Академика Скрябина, дом. 25/1,, 32.54kb.

- А. С. Попова элективный курс «культура делового общения» для 9 класса в рамках предпрофильной, 231.97kb.

^ UNIT 8. BRANDS

8.1 Look at the eight word partnerships with the word brand. Match them to the definitions below. Use a good dictionary, such as the Longman Business English Dictionary to help you.

1 A brand associated with expensive, high quality products

2 The person responsible for planning and managing a brander product

3 The brand with the largest market share

4 A famous brand with a long history

^ 5 The ideas and beliefs which consumers have about a brand

6 The tendency of a costumer to continue buying a particular product

7 Using a successful brand name to launch a product in a new category

8 The knowledge which consumers have of a brand

^ 8.2 Complete these sentences with word partnership from the list

1 Levis, which has been established for over a 100 years and is world-famous, is a ................ .

2 The aim of the advertising campaign is to enhance ....................... so that consumers become more familiar with our coffee products.

3 Volvo’s .................... is that of a well-engineered, upmarket, safe car.

4 Suchard is a ...................... of Swiss chocolate.

8.3 Complete this extract from the interview with the words below.

^ WHAT IS BRANDING?

| money name differentiate synergy quality competitors’ |

‘What is branding and why do we need brands?’

‘A brand can be a ................. 1 , a term or a symbol. It is used to .................... 2 a product from ................... 3 products. The brands guarantee a certain .....................4 level. Brands should add value to products. It’s a ..................... 5 effect whereby one plus one equals three. But customers must believe they get extra value for ........................6 .

^ 8.4 Match these words and phrases with the definitions.

| 1 global offensive 2 counterfeiter 3 copyright abuse 4 a network 5 merchandise 6 corporate strategy 7 logo 8 licensing rights 9 to rip off 10 restructure | a) plans of a company to achieve its objectives b) agreements which allow a company to make and sell a registered product locally c) taking strong action all over the world d) a person who copies goods in order to trick people e) to copy someone else’s work, for example their designs, without permission f) a large number of people or organisations working together as a system g) goods for sate h) to change the way something is organised i) the symbol of a company or other organisation j) to sell illegal copies of a brand as if they are the real thin |

Занятие 30

English Discoveries.

The Executive. Customer Service

Занятие 31

Контрафакт и контрафактная продукция. Меры по борьбе с контрафактной продукцией.

^ 8.6 Read the article again and answer these questions.

1. What was Calvin Klein’s attitude to counterfeiting in the past?

2. Why has the company changed its way of dealing with counterfeiters?

3. What has the company done to change the way its business operates and to increase its size?

^ 8.7 Fashion Victim Fights Back

Walk into a street market anywhere from Manila to Manchester, and someone will be selling T-shirts branded with the distinctive CK logo of Calvin Klein, the New York fashion designer.

If the price is very low the T-shirts are probably fakes. Calvin Klein, like most other internationally-known fashion designers, has, for a long time, had problems with counterfeiters selling poor quality merchandise bearing his brand name. Now he is doing something about it. ‘As the Calvin Klein brand has become well-known, we’ve seen a big increase in counterfeit activity,’ says Gabriella Forte, chief executive of Calvin Klein. ‘The better-known the brand name, the more people want to rip it off.’

In the past Calvin Klein took a relatively passive approach to the counterfeit problem. The company has now got tougher by establishing a network of employees and external specialists to uncover copyright abuse.

The move began with a general change in corporate strategy whereby Calvin Klein has aggressively expanded its interests outside North America. Calvin Klein has been one of the leading fashion designers in the North American market since the mid-1970s. Now Calvin Klein is building up its fashion business in other countries. It has increased its investment in advertising, and restructured its licensing arrangements by signing long-term deals with partners for entire regions such as Europe or Asia, rather than giving licensing rights to individual countries. But as sales and brand awareness have risen, Calvin Klein has become an increasingly popular target for Asian and European counterfeiters, alongside other luxury brands such as Gucci, Chanel and Ralph Lauren.

The fake goods, mostly T-shirts, jeans and baseball caps, not only reduce the company’s own sales but damage its brand image by linking it to poor quality merchandise. ‘You’d be amazed at how many people pay $5 for a T-shirt without realising it’s counterfeit,’ said one executive.

From the ^ Financial Times

8.8 Counterfeiting

I’m worried about the sales of the range of fragrances we .....................1 (launch) two years ago. In the first year, sales ..................... 2 (increase) steadily. However, since the beginning of this year, sales ...................... 3 (fall) by almost 10%.

The reason for this is clear. Several firms in SE Asia ........................ 4 (copy) our designs and are now flooding the French market with them. This ...................5 (become) a serious problem.

Last month, I ........................ 6 (organise) a team of investigators. Up to now, they ..........................7 (find) many counterfeit goods, which the police 8 (seize) and impounded.

Yesterday, I ........................8 (contact) several firms who 10 (inform) me that they ..................11 (have) similar problems. They all ......................12 (lose) sales because of counterfeiting.

^ 8.9 Three Promotions

Read the three case studies below. Then discuss the questions that follow each one.

Case 1. McDonald’s

The famous fast food company, McDonald’s, launched Campaign 55 to help it compete against rivals like Burger King and Wendy’s. They had a six-week promotion costing $320 million. McDonald’s offered a Big Mac (a type of hamburger) for 55 cents instead of $1.90. When customers were at the cash register, they found that they had to buy french fries and a drink at the full price to get the cheap burger.

- Why do you think this promotion was unpopular with McDonald’s customers?

- How do you think McDonald’s dealt with the situation?

Case 2. Pepsi

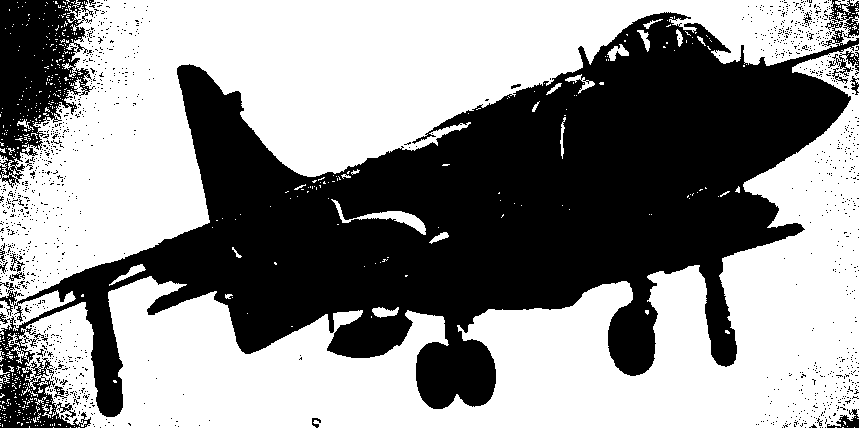

The Pepsi Cola company had the idea of offering a Harrier jump jet (see picture) as a ‘joke’ promotion. The advertisement was first shown in the Seattle area in US. It showed a teenager modelling some merchandise available as part of the Pepsi Stuff promotion. At the end, a Harrier jet landed outside the school and the boy came out of the cockpit saying, ‘It sure beats taking the bus to school.’

The promotion rules allowed customers to save up Pepsi Stuff points by collecting labels from Pepsi or buying them directly for 10 cents each. The advert stated — jokingly — that 7 million points were needed for someone to claim the jet. A business student, John Leonard, intends to take Pepsi Cola to court regarding the promotion because he thinks they should give him the prize.

- What prize do you think John Leonard is claiming from Pepsi Cola?

- What did he do to claim the prize?

- Why do you think Pepsi Cola have described his claim as frivolous (not serious)?

Case 3. Irish Tourist Board

The Irish Tourist Board used to have the shamrock (see picture) as its symbol1. Recently it spent £100,000 developing a new logo to attract tourists to Ireland2. The logo showed two people with their arms outstretched in welcome. A tiny shamrock can be seen between the two bodies.

The new logo was part of a campaign to promote Ireland as a modern country offering good food and company. It was put on all the Tourist Board’s promotional material. The television and advertising campaign included music by the well-known group The Cranberries and showed pictures of a romantic, funloving Ireland. It was very successful abroad. Tourism increased by 14% in four months.

Unfortunately the Irish people didn’t like the new logo. The Minister of Tourism ordered the Tourist Board to get rid of the logo and bring back the shamrock — or something similar3.

- Why do you think the Irish people disliked the logo so much?

- Was the Minister right to get rid of the logo?

- Which logo do you prefer?

Занятие 32

English Discoveries.

The Executive. Customer Service

Занятие 33

Международная торговля. Термины международной торговли. Способы платежей в международной торговле. Типы аккредитивов.

^ UNIT 9. MONEY MATTERS

In business there are many occasions on which people have to deal with money and talk about money. Within a company there are business situations in which receipt of money and the payment of money is the central occupation. This unit gives students the opportunity to use and practise English in some of the most relevant settings. These include ‘reminding a customer of non-payment’, ‘invoicing customers’ and dealing with credit assessment or customers. Various types of payment may be encountered in international trade. Some of the more common ones arc discussed below under ‘Methods of Payment in Foreign Trade’.

One of the more common methods of payment it ‘payment by letter of credit’. Particular practice is given in this unit on ‘reminding a customer of non-payment’ and ‘dealing with cash-flow problems’ as these are areas in which communication in English is most likely to he required.

But more general situations and settings in which people talk about money and related matters, such as foreign currency, shares and business ownership, and the financial performance of a company are also treated in this unit.

^ 9.1 Methods of payment in foreign trade

1. CWO — Cash with order: This is uncommon since you are in effect extending credit to your supplier: in addition you run she risk that the goods will not be despatched in accordance with the Contract terms. Nevertheless, provision for partial advance payments in the form of deposits (normally between 10 per cent and 20 per cent of the contract price), or progress payments at various stages of manufacture (particularly for capital goods), is often included in the contract terms. The remainder of the payment will usually be made by one of the methods described in the following section headed ‘Open Account’.

2. ^ Open account: This is a simple agreement whereby you agree to pay for the goods after you have received them, usually on a monthly basis. There are various ways in which you can send money to your supplier under open account and he may wish to stipulate the method to be used, for example:

Cheque: This is usually the slowest method of payment and may result in your supplier having to bear charges from his own bank and also from UK banks since a cheque has to be cleared through the international banking system before he receives credit. Different banks have different methods and this could take as long as a month.

For these reasons your supplier may not consider payment by cheque acceptable.

^ Banker’s Draft: You can arrange for your bank to issue a draft drawn on an overseas bank in either sterling or foreign currency. You send this direct to your supplier who pays it into his bank account, at which time he will usually be given immediate credit.

Telegraphic Transfer: This is the fastest method of sending money abroad but costs a little more than most other methods of transferring funds. Your UK bank instructs an overseas bank, by cable or telex, to pay a stated amount of money to your supplier. Foreign currency or sterling may be sent in this way. If you wish, the overseas bank can be instructed to advise your supplier immediately funds arrive.

^ International Payment Order: You can arrange for your bank to instruct an overseas bank, by airmail, to make payment to your supplier. International Payment Orders may be slower than Telegraphic Transfers, but are slightly cheaper because there are no cable costs.

International Money Order: These can be purchased from your bank. You post the money order to your supplier and he receives immediate credit from his bank in the same way as with a draft. This is a very cheap and simple way to make payment of relatively small amounts.

3. Documentary Bill Of Exchange: This is a popular way of arranging payment and offers benefit for both you and your supplier. The main advantage is that you are not required to make payment until your supplier has despatched the goods. Your supplier has the advantage of knowing that legal procedures exist for recovering money owing against bills of exchange and, if the goods are sent by sea, is able to maintain control of the goods through the document of title until you have agreed to make payment. It is in effect a demand for payment from your supplier. He will draw it up on a specially printed form or on his own headed notepaper and forward it to his bank, together with she documents relating to the transaction. These may include a transport document evidencing that the goods have been despatched.

The overseas bank will send the bill and documents to a bank in the UK for ‘collection’. The UK bank will notify you of the arrival of the documents and will release them to you provided that:

- if the bill is drawn at ‘sight’ you pay the amount of the bill in full when it is presented to you.

- if the bill is drawn payable after a certain number of days you ‘accept’ the bill, i.e. sign across the bill your agreement to pay the amount in full on the due date.

^ 9.2 Letters of Credit

The Irrevocable Letter of Credit is the most commonly used method of payment for imports. The exporter can he sure that he will he paid when he dispatches the goods and the importer has proof that the goods have been dispatched according to his instructions.

The ‘letter’ is an inter-bank communication. The two banks take full responsibility that both shipment and payments are in order.

The importer and exporter agree a sales contract and the terms of she Documentary Credit.

- The importer asks his hank in open a Documentary Credit in the exporter’s favour.

- The importer’s bank (the issuing bank) sends a Letter of Credit to a bank in the exporter’s country (the advising bank).

- The exporter presents the shipping documents to the advising bank as proof that the shipment has been dispatched. If everything is in order, he is paid.

- The advising bank sends the documents to the issuing bank.

- The advising bank sends the documents to the importer, who uses them to obtain delivery of the goods.

A partial glossary of some of the technical terms:

revocable = a letter of credit etc which is able to he cancelled

bills of exchange = documents containing an instruction usually to a bank to pay a stated sum of money at a specified future date or on demand

drawn at sight = a bill of exchange which is payable when the beneficiary presents it at the hank is said to be drawn at sight

of a particular tenor = according to started terms or in a specified manner or at a specified time

port of discharge = the port at which the cargo is unloaded etc

| ^ Barclays Bank PLC 1 Union Court, London D 1 OCUMENTARY CREDITS DEPARTMENT date 20th July 19 SPECIMEN Irrevocable credit № UTDC 65432 Beneficiary (ies) Speirs and Wadley Ltd. Adderley Road Hackney, London 2 Advised through 3 Accreditor Woldal Ltd. New Road Kowloon, Hong Kong To be completed only if applicable Our cable of Advised through Refers Dear Sir (s) In accordance with instructions received from The Downtown Bank & Trust Co. We hereby issue in your favour a Documentary Credit for £4108 ( 4 5 say) Four thousand, one hundred and eight pounds sterling available by your drafts drawn on us a 6 t sight for the 100% c.i.f. invoice value, accompanied by the following documents:- 1 7 . Signed Invoice in triplicate. 2. Full set of clean Combined Transport Bills of Lading made out to order and blank endorsed, marked ‘Freight Paid’ and ‘Notify Woldal Ltd., New Road, Kowloon Hong Kong’. 3. Insurance Policy or Certificate in duplicate, covering Marine and War Risks up to buyer’s warehouse, for invoice value of the goods plus 10%. Covering the following goods:- 8 400 Electric Power Drills 9 T 6 o be shipped from London 10 Hong Kong c.i.f. n  ot later than 10th August 19.. ot later than 10th August 19..10 P 11 artshipment not permitted Transhipment permitted The credit is available for presentation to us until 31st August 19.. Documents to be presented within 21 days of shipment but within credit validity. ^ Drafts drawn hereunder must be marked “Drawn under Barclays Bank PLC 1 Union Court, London branch, Credit number UTDC 65432 We undertake that drafts and documents drawn under and in strict conformity with the terms of this credit will be honoured upon presentation. Yours faithfully   Co-signed (Signature № 9847 ) Signed (Signature № 1027 ) |

This is the correct numbered order. Most Credits are fairly similar in appearance and contain the following details:

- The type of Credit (Revocable or Irrevocable).

- The name and address of the exporter (beneficiary).

- The name and address of the importer (accreditor).

- The amount of the Credit is sterling or a foreign currency.

- The name of the party on whom the bills of exchange are to be drawn, and whether they are to be at sight or of a particular tenor.

- The terms of contract and shipment (i.e. whether ‘ex-works’, ‘FOB’, ‘CIF’, etc.).

- Precise instructions as to the documents against which payment is to be made.

- A brief description of the goods covered by the Credit (too much detail should be avoided as it may give rise to errors, which can cause delay).

- Shipping details, including whether transhipments are allowed. Also recorded should be the latest date for shipment and the names of ports shipment and discharge. (It may be in the best interest of the exporter for shipment to be allowed ‘from any UK port’ so that he has a choice if, for example, some ports are affected by strikes. The same applies for the port of discharge.)

- Whether the Credit is available for one or several shipments.

- The expiry date.

Most Credits are fairly similar in appearance and contain the following details:

- The terms of contract and shipment (i.e. whether ‘ex-works’, ‘FOB’, ‘CIF’, etc.).

- The name and address of the importer (accreditor).

- Whether the Credit is available for one or several shipments.

- The amount of the Credit in sterling or a foreign currency.

- The expiry date.

- A brief description of the goods covered by the Credit (too much detail should be avoided as it may give rise to errors, which can cause delay).

- The name and address of the exporter (beneficiary).

- Precise instructions as to the documents against which payment is to be made.

- The type of Credit (Revocable or Irrevocable).

- Shipping details, including whether transhipments are allowed. Also recorded should be the latest date for shipment and the names of ports shipment and discharge. (It may be in the best interest of the exporter for shipment to be allowed ‘from any UK port’ so that he has a choice if, for example, some ports are affected by strikes. The same applies for the port of discharge.)

- The name of the party on whom the bills of exchange are to be drawn, and whether they are to be at sight or of a particular tenor.